Need a Mortgage Broker, Mortgage Lender or Servicer License or Just Looking For More Information About The Requirements?

Click on a state below to learn more about the necessary mortgage licensing requirements.

- Alabama

- Alaska

- Arizona

- Arkansas

- California

- Colorado

- Connecticut

- Delaware

- Florida

- Georgia

- Hawaii

- Idaho

- Illinois

- Indiana

- Iowa

- Kansas

- Kentucky

- Louisiana

- Maine

- Maryland

- Massachusetts

- Michigan

- Minnesota

- Mississippi

- Missouri

- Montana

- Nebraska

- Nevada

- New Hampshire

- New Jersey

- New Mexico

- New York

- North Carolina

- North Dakota

- Ohio

- Oklahoma

- Oregon

- Pennsylvania

- Rhode Island

- South Carolina

- South Dakota

- Tennessee

- Texas

- Utah

- Vermont

- Virginia

- Washington

- West Virginia

- Wisconsin

- Wyoming

- DC and Territories:

- District of Colombia

- Guam

- Puerto Rico

- Virgin Islands

Mortgage Broker Licensing Guide

Becoming a licensed mortgage broker requires meeting a range of federal and state-specific requirements. While the exact process varies by state, all applicants must apply through the Nationwide Multistate Licensing System & Registry (NMLS). Below is a step-by-step guide to help you understand the process, requirements, and costs involved.

If you’re a mortgage professional and interested in becoming a mortgage broker, the first step is to obtain a mortgage broker license.

Our Mortgage Broker Licensing team will guide you through the process to the finish line.

1. Application Process and Fees

When applying for a mortgage broker license, you will incur several fees through the NMLS, including:

- NMLS processing fee

- State application fee (varies by state)

- Credit report fee

- FBI criminal background check fee

Typical costs range from $1,000 to $3,000, depending on the state. Some states itemize their fees individually, while others charge a lump sum that covers all requirements. In certain states, the total can exceed $5,000, particularly where higher surety bonds are required.

2. Professional Experience Qualification

Many states require applicants—or their designated Qualified Individual (QI)—to have prior mortgage industry experience, usually 1–3 years.

Experience may include:

- Loan origination

- Branch or brokerage management

- Other directly related mortgage industry roles

Some states allow applicants without prior experience if they employ a QI who meets the requirement.

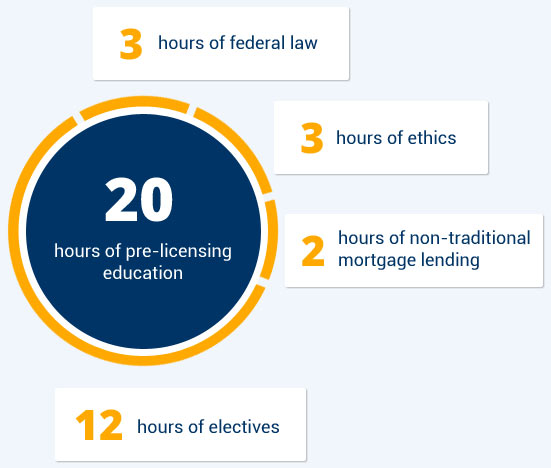

3. Education and Testing Requirements

All applicants must complete at least 20 hours of NMLS-approved pre-licensing education. Some states require additional state-specific hours.

Core SAFE Act Pre-Licensing Requirements (20 Hours Minimum):

- 3 Hours of Federal Law

- 3 Hours of Ethics

- 2 Hours of Non-Traditional Mortgage Lending

- 12 Hours of Electives (or state-specific coursework, depending on the state)

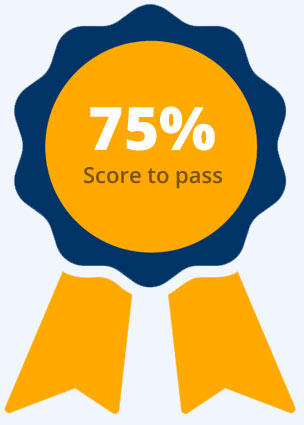

After completing your education, you must pass the SAFE Mortgage Loan Originator (MLO) Exam – National Component with Uniform State Content (UST).

- Passing score: 75%

- Retakes:

- If you fail, you must wait 30 days before retaking.

- After a 3rd failed attempt, the waiting period increases to 180 days.

- These retest waiting periods are mandated under the SAFE Act.

4. Qualified Individual (QI) Requirement

Every mortgage brokerage must appoint a Qualified Individual (QI) who is responsible for ensuring compliance with state and federal regulations.

QI requirements typically include:

- Must reside in the state (in many, but not all, jurisdictions)

- Must have the required industry-related experience

- Must complete NMLS education and pass the SAFE exam

- Must pass a credit history and FBI background check

- Must meet any state-specific rules

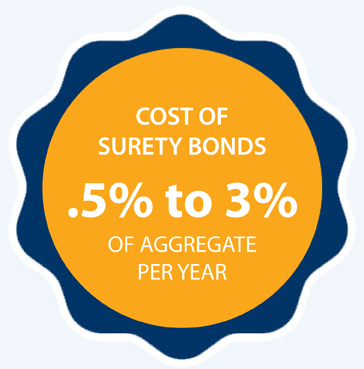

5. Surety Bond Requirements

Most states require mortgage brokers to maintain a surety bond as financial protection for consumers.

- Bond amounts are typically based on loan volume or the type of investors used.

- Requirements generally range between $25,000 and $150,000, though some states set higher minimums (up to $500,000 in certain cases).

- Bonds must be renewed annually.

6. Location Requirements

Some states require mortgage brokers to maintain a brick-and-mortar office in-state.

- States such as Arizona, Nevada, and North Carolina require a physical office.

- Other states allow out-of-state companies to operate remotely as long as they are properly registered.

- In New Jersey, the Department of Banking and Insurance also inspects locations to ensure compliance with client privacy and zoning ordinances.

7. Business Entity Registration

Before applying, you must register your business entity.

- Obtain an EIN (Employer Identification Number) from the IRS.

- Register your company with your state’s Secretary of State.

- Ensure your entity type (LLC, Corporation, Partnership) meets state requirements.

8. Trusted Software & Compliance Tools

To stay organized and compliant, mortgage brokers should implement secure, scalable software solutions that:

- Integrate with third-party systems

- Simplify compliance reporting

- Maintain analytics for customer tracking

- Support marketing and communication efforts

9. Building Your Network

Networking is critical for success in mortgage brokerage. Strong relationships with lenders and clients can provide long-term growth.

Ways to build your network:

- Attend mortgage industry events, conferences, and seminars

- Offer a wide range of loan products

- Maintain open communication with clients and lenders

- Prioritize customer service and follow-up

10. Continuing Education & Renewal

Licenses must be renewed annually through the NMLS between November 1 and December 31.

Annual Continuing Education (CE) Requirements:

- 3 Hours of Federal Law

- 3 Hours of Ethics

- 2 Hours of Non-Traditional Mortgage Lending

- State-Specific CE (1–5 hours depending on the state)

If renewal is missed, some states allow late reinstatement—but many do not. Renewal and reinstatement must be processed through NMLS, and reinstatement windows vary by state.

Final Notes

Mortgage broker licensing is a regulated process that varies by state, but the fundamentals—application, education, testing, bonding, and compliance—apply nationwide. Staying informed on state-specific rules and maintaining continuing education is critical to long-term success.

COMPLETE YOUR BUSINESS ENTITY REGISTRATION (Forming your Company)

Every company except a sole proprietorship needs an EIN from the IRS to register with the NMLS regardless of whether or not they’re going to hire people.

COMPLETE THE REQUIRED MORTGAGE BROKER TRAINING

The NMLS requires you to take 20 hours of pre-licensing education prior to applying for the license

- 3 Hours of Federal Law

- 3 Hours of Ethics

- 2 Hours of Non-Traditional Mortgage Lending

- 12 Hours of Electives

TAKE AND PASS THE SAFE MORTGAGE LOAN ORIGINATOR EXAM – National Component with Uniform State Content (UST)

The test usually consists of two parts:

- Federal Regulations and Laws

- State Rules and Laws

To pass, you need a minimum score of 75% (If you fail, there is a 30 day waiting period before retesting and after 3rd failure you must wait 180 days to retest)

SUBMIT A MORTGAGE BROKER LICENSE APPLICATION

License are handled through the Nationwide Multistate Licensing System (NMLS). Their website contains detailed information on each state’s specific requirements.

Typical requirements include:

- Getting a mortgage broker bond

- Submitting fingerprints (State Specific)

- Paying licensing fees

- Submitting a FBI criminal background check

OBTAIN A SURETY BOND

Even though it is not a requirement in all states, surety bonds are mandatory in many places. Surety bonds ensure that mortgage brokers are compliant with state and local applicable laws and regulations and add an extra layer of protection for homebuyers. A surety bond must be renewed on a yearly basis as applicable.

USE TRUSTED SOFTWARE

Keep organized and don’t limit your ability to grow, implement secure and trusted software solutions that your team can efficiently work with.

Software solutions should:

- Sync with 3rd party software and processes

- Make reporting easy

- Maintain customer support through analytics

- Help designate marketing efforts where necessary

BUILD YOUR NETWORK

Building rapport with a trusted network of buyers and lenders is key to the success of any mortgage broker.

Ways to build:

- Sign up for events, conferences and seminars

- Offer a broad variety of products

- Implement different communication methods

- Place an emphasis on customer service

RENEW AND MAINTAIN YOUR CONTINUING EDUCATION

Besides renewing your bond, you will also need to take a minimum of 8 hours of continuing education to maintain your license. Some states also require state specific CE hours ranging from an additional 1 to 5 hours.

- 3 Hours of Federal Law

- 3 Hours of Ethics

- 2 Hours of Non-Traditional Mortgage Lending

- 1 Hour of Electives

- Any State Specific Course

Renewal of company, branch and mlo’s is required annually. The renewal window is Nov. 1 through Dec. 31st. Some states offer late renewals, called reinstatements, however many do not. Make sure to renew on time!