Get Licensed in a Brick and Mortar State!

Here are some things you should know about the 5 Brick and Mortar States

Since 2008, new laws have been created, regulated, and implemented to ensure the protection of consumers nationwide. The Nationwide Multistate Licensing System & Registry (NMLS) was born as a result and designed to house a record of all the new licenses required by mortgage companies, and other financial servicing companies, to serve as a brief information guide for all licensing requirements in each state as they were monitored, updated, and differentiated across the entire United States and its territories.

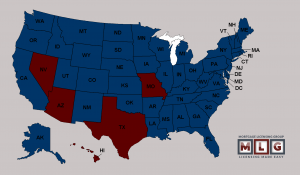

As most mortgage companies know, there are a number of steps to be completed in order to conduct any loan activity and business within a state. Some state licenses contain specific education requirements, while others will also require additional documents and qualified individual requirements. Alongside many of these regulated prerequisites, there are five states which also require a brick and mortar location. These states are: Arizona, Hawaii, Missouri, Nevada, and Texas.

WHAT IS A BRICK AND MORTAR LOCATION?

According to Investopedia.com, a brick and mortar location “refers to a traditional street side business that deals with its customers face to face in an office or store that the business owns or rents.” Depending on which state takes your business’s interest, the defining qualifications of what constitutes an approved brick and mortar location varies. Let’s take a look at the what’s needed to expand your business into a brick and mortar state:

Arizona

Arizona requires a brick and mortar location, and a Resident Individual [or] Responsible Individual [RI] to be employed at the designated location. A Responsible Individual [RI] will also be the person who serves as the Qualified Individual [QI] for your company. This person must live in AZ, be employed by your company, have three years, or more, of business experience relative to your company, and qualify as a financially stable person determined by a credit report and a few other qualifiers. Your RI isn’t required to be licensed, as long as they are not conducting any loan activity. This person will help manage your company and other business matters, while operating at the indicated and approved brick and mortar location within the state of Arizona. For more details about AZ-RI check out our blog!

Interested in expanding your business with an AZ company and branch license? The Mortgage Licensing Group offers an array of licensing services to help diversify your business. Contact a license specialist today to get started with MLG’s exclusive AZ-RI Program!

Hawaii

Beach front property, vacation rentals, the scent of plumeria trees grazing the beach breeze, while sipping on uniquely, hand-crafted Mai Tai’s, on sands in the heart of Waikiki. Aloha! Wouldn’t you like this to be your weekend possibility? Make your dream come true with a Hawaii Mortgage Loan Originator Company License!

Hawaii requires mortgage companies to acquire a brick and mortar location within the state. Since a company may only file a single company record, also known as an MU1 form, to the NMLS, a branch form must be filed, and a new branch will be formed as a way to expand your company into the beautiful state of Hawaii. Similar to AZ, Hawaii requires the Qualifying Individual [QI] to be assigned as the branch manager, overseeing business activities operating within the branch location. This person is referred to as the Hawaii Principal Place of Business branch manager and must hold an active HI mortgage loan originator license.

Interested in accomplishing the steps towards your retirement? Become licensed in HI and become the QI of your dreams! Call MLG and learn more about acquiring a company license and a branch in Maui! A team of licensing specialists will help you pave the way for your dreams!

Missouri

The Show Me State can show you new ways of expanding your business into one of the most underrated places in the United States. Missouri is in the middle of everything! Missouri is the Gateway to the West; from different dialects of accented English, to museums, riverboat tours, and some of the country’s best barbeque, Missouri is only one branch location away from making your company super!

Like its sports teams, Missouri takes your brick and mortar location very seriously! When expanding into MO, your brick and mortar location is recognized as the corporate location of your company by the Division of Finance, and other regulatory agencies within the state. Unless your company solely services loans, or meets qualifications to be considered a Manufactured Housing Designation loan company, you will be required to open a brick and mortar location within the state of Missouri. Your company license will require an employed individual to be a resident of, and licensed in, the state of Missouri. The designated Branch Manager will be regarded as the Qualified Individual for your company, and oversee the loan activities operating in your new Missouri branch!

Interested in obtaining a company and branch license in Missouri? Show us! Visit our website or email info@mymortgagelicense.com to schedule a call with our License Specialists today!

Nevada

What loan activity happens in Vegas… must be licensed in Vegas… well, Nevada. From bighorn sheep and great hikes near the Alpine Lakes, to the wild strip of Las Vegas, Nevada may be the next best place for homebuyers to purchase affordable homes, and can bet your mortgage company will prosper with a Nevada Mortgage Broker License.

Mortgage companies expanding into Nevada are required to have an in-state location. There are a few exceptions to this rule, such as companies with in-state corporate offices, whole sale lenders, and servicing companies. The brick and mortar location can even be a residential location, as long as the residence is not located in a gated community, and the owner of the property is the only individual originating loans within your licensed branch.

Two Qualified Employees are required for license in Nevada, if headquartered outside of the state: One must be employed by the branched location, and the other by your corporate office. Experience is also required as part of the QE requirements; two of the last five years must contain verifiable experience within the mortgage industry, which then requires both individuals to have met all requirements concerning the S.A.F.E Mortgage Licensing Act. For more information on S.A.F.E Mortgage Licensing Act requirements, contact The Mortgage Licensing Group’s devoted team of License Specialists.

Betting on expanding your company into NV? Don’t be afraid to go all in! The Mortgage Licensing Group can get you one step closer to the jackpot! Contact our offices today for your Nevada Company and Branch License!

Texas

Everything is bigger in Texas! Including companies with a Texas Mortgage Company License. Open a brick and mortar location in the state bigger than the size of countries.

Prices of homes are on the rise along the coasts; and with a huge state full of affordable homes, big enough to raise families, welcomed with some Texan southern hospitality, bless your heart, if you don’t think expanding into Texas should be one of your 2019 expansion goals.

Of course, we’d save the best for last! Texas requires your company to have a physical location within the Lone Star State if your company is headquartered beyond state lines. The branch manager, assigned to this branch, must also be licensed in the state of Texas, however, the branch manager can still be an employee located at your corporate office. Unlike, many other states, Texas does not have a distance rule. A distance rule implements a range of distance in which an individual is allowed to reside, relative to their work location. Many states require an individual to live within a certain proximity of the employment location to determine the approval of their license.

Have an office suite you’d like to branch in the state of Texas? Don’t be scared as a cat in a dog pound! Call MLG and speak to our very own Texas native, Senior License Specialist, Nicholas Graham, to get started on making your company bigger! Getting a Texas license will have you as happy as a clam at high tide!

The Mortgage Licensing Group, Inc. is a full-service mortgage licensing firm headquartered in Southern California that is recognized throughout the industry as an experienced and reliable service provider. Established in 2006, our company has been on the forefront of the ever-changing rules and regulations, helping alleviate the often daunting task of meeting the diverse state licensing requirements for our clientele.